A variety of measures of national income and output are used in economics to estimate total economic activity in a country or region.

A variety of measures of national income and output are used in economics to estimate total economic activity in a country or region, including gross domestic product (GDP), gross national product (GNP), net national income (NNI), and adjusted national income (NNI* adjusted for natural resource depletion). All of the measures are especially concerned with counting the total amount of goods and services produced within some boundary. The boundary is usually defined by geography or citizenship, and may also restrict the goods and services that are counted. For instance, some measures count only goods and services that are exchanged for money, excluding bartered goods, while other measures may attempt to include bartered goods by imputing monetary values to them.

Arriving at a figure for the total production of goods and services in a large region like a country entails a large amount of data-collection and calculation. Although some attempts were made to estimate national incomes as long ago as the 17th century, the systematic keeping of national accounts, of which these figures are a part, only began in the 1930s, in the United States and some European countries. The impetus for that major statistical effort was the Great Depression and the rise of Keynesian economics, which prescribed a greater role for the government in managing an economy, and made it necessary for governments to obtain accurate information so that their interventions into the economy could proceed as well-informed as possible.

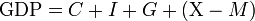

Expenditure approach: The expenditure approach is a common method for evaluating the value of an economy at a given point in time.

In order to count a good or service, it is necessary to assign value to it. The value that the measures of national income and output assign to a good or service is its market value – the price when bought or sold. The actual usefulness of a product (its use-value) is not measured – assuming the use-value to be any different from its market value. Three strategies have been used to obtain the market values of all the goods and services produced: the product or output method, the expenditure method, and the income method.

The output approach focuses on finding the total output of a nation by directly finding the total value of all goods and services a nation produces:

At factor cost = \(\mathrm\) at market price – depreciation + \(\mathrm\) (net factor income from abroad) – net indirect taxes

The income approach equates the total output of a nation to the total factor income received by residents or citizens of the nation:

\(\mathrm\) at factor cost = compensation of employees + net interest + rental and royalty income + profit of incorporated and unincorporated \(\mathrm\) at factor cost

The expenditure approach focuses on finding the total output of a nation by finding the total amount of money spent and is the most commonly used equational form:

\(\mathrm\); where \(\mathrm\) = household consumption expenditures / personal consumption expenditures, \(\mathrm\) = gross private domestic investment, \(\mathrm\) = government consumption and gross investment expenditures, \(\mathrm\) = gross exports of goods and services, and \(\mathrm\) = gross imports of goods and services.

Personal income is an individual’s total earnings from wages, investment interest, and other sources.

Personal income is an individual’s total earnings from wages, investment interest, and other sources.

In the United States the most widely cited personal income statistics are the Bureau of Economic Analysis’s (BEA) personal income and the Census Bureau’s per capita money income. The two statistics spring from different traditions of measurement: personal income from national economic accounts and money income from household surveys.

BEA’s personal income measures the income received by persons from participation in production, from government and business transfers, and from holding interest-bearing securities and corporate stocks. Personal income also includes income received by nonprofit institutions serving households, by private non-insured welfare funds, and by private trust funds. BEA publishes disposable personal income, which measures the income available to households after paying federal and state and local government income taxes. Income from production is generated both by the labor of individuals (for example, in the form of wages and salaries and of proprietors’ income) and by the capital that they own (in the form of rental income of persons). Income that is not earned from production in the current period—such as capital gains, which relate to changes in the price of assets over time—is excluded. BEA’s monthly personal income estimates are one of several key macroeconomic indicators that the National Bureau of Economic Research considers when dating the business cycle. Personal income and disposable personal income are provided both as aggregate and as per capita statistics. BEA produces monthly estimates of personal income for the nation, quarterly estimates of state personal income, and annual estimates of local-area personal income.

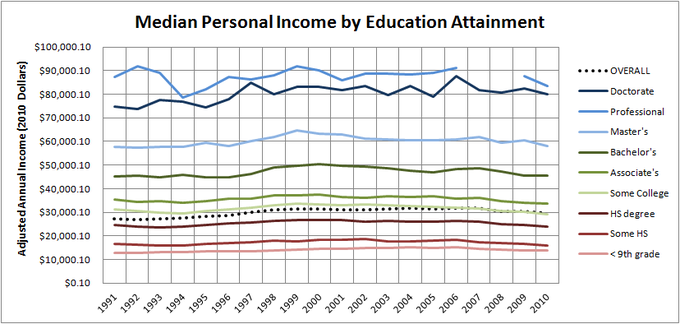

Historical personal income by educational attainment: Personal income data can provide governments with useful information in the formulation of public policy to combat income inequality.

The Census Bureau also produces alternative estimates of income and poverty based on broadened definitions of income that include many of these income components that are not included in money income. The Census Bureau releases estimates of household money income as medians, percent distributions by income categories, and on a per capita basis. Estimates are available by demographic characteristics of householders and by the composition of households.

Disposable income is the income left after paying taxes.

Income left after paying taxes is referred to as disposable income. Disposable income is thus total personal income minus personal current taxes. In national accounts definitions:

Disposable income: Disposable income can be spent on essential or nonessential items. Alternatively, it can also be saved. It is whatever income is left after taxes.

Personal income – personal current taxes = disposable personal income

This can be restated as: consumption expenditure + savings = disposable income

For the purposes of calculating the amount of income subject to garnishment, United States federal law defines disposable income as an individual’s compensation (including salary, overtime, bonuses, commission, and paid leave) after the deduction of health insurance premiums and any amounts required to be deducted by law. Amounts required to be deducted by law include federal, state, and local taxes, state unemployment and disability taxes, social security taxes, and other garnishments or levies, but does not include such deductions as voluntary retirement contributions and transportation deductions.

Discretionary income is disposable income minus all payments that are necessary to meet current bills. It is total personal income after subtracting taxes and typical expenses (such as rent or mortgage, utilities, insurance, medical fees, transportation, property maintenance, child support, food and sundries, etc.) needed to maintain a certain standard of living. In other words, it is the amount of an individual’s income available for spending after the essentials (such as food, clothing, and shelter) have been taken care of.

Discretionary income = Gross income – taxes – all compelled payments (bills)

Disposable income is often incorrectly used to denote discretionary income. The meaning should therefore be interpreted from context. Commonly, disposable income is the amount of “play money” left to spend or save.

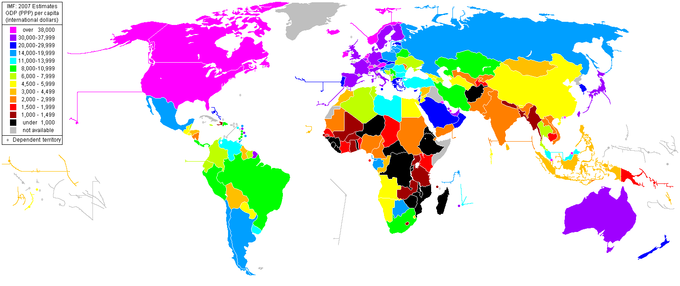

Gross domestic product (GDP) per capita is the mean income of people in an economic unit.

Gross domestic product (GDP) per capita is also known as income per person. It is the mean income of the people in an economic unit such as a country or city. GDP per capita is calculated by dividing GDP by the total population of the country.

GDP per capita is often used as average income, a measure of the wealth of the population of a nation, particularly when making comparisons to other nations. It is useful because GDP is expected to increase with population, so it may be misleading to simply compare the GDPs of two countries. GDP per capita accounts for population size.

Comparisons of GDP per capita: GDP per capita varies across countries and is highest among developed countries. However, GDP per capita is not an indicator of income distribution in a given country. For this reason GDP per capita may not necessarily be a barometer for the quality of life in a given country.

Per capita income is often used to measure a country’s standard of living. It is usually expressed in terms of a commonly used international currency such as the Euro or United States dollar. It is easily calculated from readily-available GDP and population estimates, and produces a useful statistic for comparison of wealth between sovereign territories. This helps countries know their development status.

However, critics contend that per capita income has several weaknesses as a measure of prosperity, including:

LICENSES AND ATTRIBUTIONS

CC LICENSED CONTENT, SPECIFIC ATTRIBUTION

This page titled 19.2: Other Measures of Output is shared under a CC BY-SA 4.0 license and was authored, remixed, and/or curated by Boundless.